- #Multiledger general ledger out of balance software#

- #Multiledger general ledger out of balance trial#

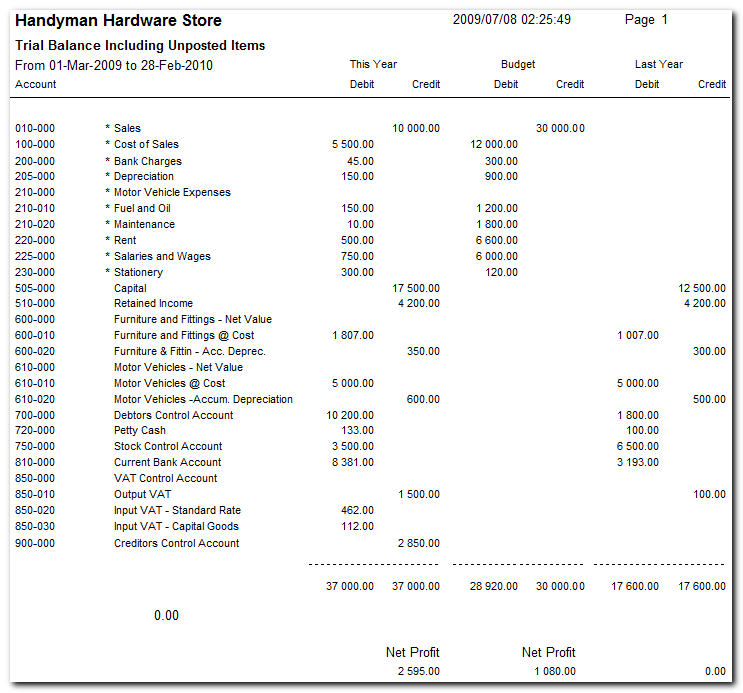

If you find an inactive account with a balance set it as active. Look for inactive accounts with balances. Print a Detail Journal Listing for all accounts, including inactive general ledger accounts, beginning at an audit number at which the system was in balance. Print a Chart of Accounts and ensure the total levels are correct. If you can't find an audit that is out of balance, the problem may be caused by incorrect settings on one or more general ledger accounts. Your System Balance MUST say "General ledger is out of balance". If you record a half journal entry when your general ledger is in balance, you will cause it to go out of balance. Don't enter correcting journal entries unless you understand how the entries will affect your system.ĭon't enter half journal entries unless your general ledger is already out of balance. In the case of the latter, read Hardware failures before entering adjustments. You will need to either reverse the entry or to process correcting entries if the audit is out of balance as result of a system error or hardware failure. By reviewing the description and type of the audit, determine if it is a half journal entry entered in error, or an audit entered incorrectly as result of a system error or hardware failure. Enter the first and last day of your prior period. Note: If you use both cash and accrual accounting, select the accounting method. This is evident when executing transaction MB5L (program RM07MBST) as well as transaction SP6B12000136 (program RM07MMFI). Look for an audit displaying the message "Out of balance". Print your Year-to-date Ledger for prior periods until you find the out of balance period: From Reports, select Year-to-date Ledger. We have 2 company codes whereby the inventory subledger does not agree with material general ledger account. Print it for all accounts, beginning at the audit number of your last in-balance System Balance. Common reasons for the general ledger being out of balance are system errors, hardware failures and half journal entries entered in error. If the general ledger is out of balance the System Balance will print "General ledger is out of balance" followed by the amount of the imbalance. This includes all debit and credit transactions, like revenue, expenses, assets, liabilities, and even ownership equity. This is not the same as when your System Balance is out of balance. The general ledger is a master accounting document that offers a complete record of all financial transactions at an organization. The general ledger is considered out of balance if the general ledger debits don't equal the general ledger credits. But if you were to make an entry directly to the General Ledger of an account that had a Subledger it would not balance since the entries only flow up not down.Correcting problems with the General Ledger In theory both the Subledger and General Ledger of Accounts Payable, Accounts Receivable, and Bank should always match.

#Multiledger general ledger out of balance trial#

It will also be included in the AR account on your Trial Balance (General Ledger Report).

#Multiledger general ledger out of balance software#

If you run an Accounts Receivable report (Subledger report) you will see this amount. A general ledger, also known as the book of final entry, is a record of a company’s financial transactions. First introduced in 1986, MultiLedger by CheckMark Inc provides a fully integrated, comprehensive suite of accounting software for small to. This will appear on both the AR Subledger and in the AR General Ledger. So all of the entries made to Customers will flow up to the Accounts Receivable General Ledger. Entries made to a Subledger Account flow up to the General Ledger. Under these Subledger Accounts you will have additional accounts (Bank Accounts, Customers, Vendors, Assets). The entries in the General Ledger will make the up the balances of your Accounts which will appear on the Trial Balance.Ī Subledger is used for specific types of accounts (Banking, Accounts Payable, Accounts Receivable, sometimes Fixed Assets). The General Ledger is a listing of all of the transactions going through your Balance Sheet and Income Statement accounts. Because Assets = Liabilities + Equity your Trial Balance should always balance to Zero.

Your Trial Balance is a listing of all of your accounts on your Balance Sheet and Income Statement. Accounting Just Got Easier for Small Business Owners/Managers.,MultiLedger integrated accounting combines ledger, receivables, payables, bank reconciliation. I'm going to explain this as I would to someone using an accounting system.

0 kommentar(er)

0 kommentar(er)